At some point today, I'm not sure when, my mortgage will be completely paid off. Yay! I think. I'm actually not sure what to do now.

This house was not paid off with a pot of gold.

Cue the singing angels, and unicorns sliding down a rainbow - my house is paid off. At least at some point today it will be, I just don't know when. My plan is to stay at my computer and constantly refresh my browser until I see that the final payment has been made.

AND THEN ....... !!!!

I don't know.

I guess I could have a glass of champagne or burn my mortgage agreement in the fireplace. That's the sort of thing they do in movies but if the payment goes through at 9 a.m. it seems a bit silly to start drinking champagne unless I'm also wearing a feather trimmed organza house robe with matching slippers. And I don't own any of those things including the bottle of champagne so I guess I'll just keep a glass of ice water and an Alka Seltzer handy.

I'm toying with the idea of making up a big sign like this to put on the front lawn.

But that's a lot of effort. I mean it took too much time just to Photoshop the sign in this picture let alone make a real one. That's time that could be be spent deciding on what to do with all my extra money every month. Purchase a castle? Acquire a small country? Buy only organic?

I have to tell you. I thought paying off my mortgage was going to be a lot more exciting. I realize I'm part of the problem what with not having a bottle of champagne at the ready, but it's weirdly anticlimactic. Like trying sushi for the first time.

But paying off my mortgage doesn't mean I'm going to have mountains of money to blow. I'm just going to have a mediocre amount of money to blow.

Like maybe I could rent a dancing monkey for a week every month. Or start using premium gasoline in my car.

Or, if I want to be extremely practical and smart, every month I could invest the exact same amount of money I spent on my mortgage. Which of course is exactly what I'll do because I am no fun.

Seriously. Zero fun. I get a lot of people comment or email me saying they wish we were friends because we'd have so much fun together. No we wouldn't. You'd have fun and I'd be wishing you'd go home so I could get back to chopping wood and diagnosing my cat's skin condition.

Now if I WERE a fun kind of person I'd allow myself to live a little. Maybe buy a couple of things in my first few mortgage-free months. Things I want but am too cheap to buy. Which is stupid because they're all things I'd not only use, but probably use for a lifetime.

Like a KoMo flour mill.

Or a Dyson hairdryer.

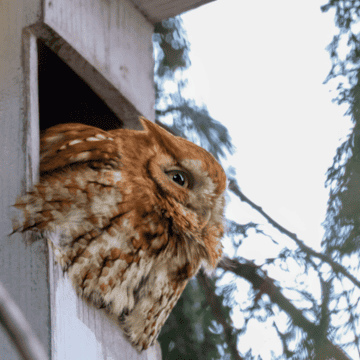

Or 42 of these hand squirrel puppets.

I think we all know what I'd get the most use out of. I mean, as so many of us do, I already have a finger puppet stage built soooo.

The other way I could go is to finally hire someone to work for me part time. That's a kind of investment. But everyone knows that's not as much fun as playing out West Side Story with an all squirrel cast.

I suppose I don't have to decide right away. I mean it's not like they're going to suddenly stop making squirrel puppets. They'll be there next month if I decide to become fun Karen.

For now my extra money is going to stay in the bank safe and sound before I find out Amazon also carries sloth finger puppets.

Have a good weekend. I'll be here constantly refreshing my computer screen.

That is HUGE, congratulations!!!!

Congratulations! I know the feeling, it’s like loosing weight except the mortgage payments never returned. It’s the only way I could have retired.

I even took a photo of me ( well my hand because it was a selfie) dropping the envelope into the mail. I did the boring “ investment “ thing but it has paid off exponentially now.

One thing I did promise myself I’d buy some memories by traveling. Unlike things, no one can repossess your memories.

Buy a rental property!

I know, but those can be a LOT of work. I have relatives who have a few and there's always something going wrong with one of them. I don't feel confident I'd have the time to be able to devote to one. Kind of like bees, lol. ~ karen!

Oh yes! As a fellow blogger I totally understand! No time for fun since there is always that huge 'Blog-parrot' sitting on my shoulder painfully pecking at my head saying; 'come on, get going and making/writing a post!' No time to sit around enjoying yourself!

Barb, I went to your site. I think your sentence, “No time to sit around enjoying yourself.”, is wrong. There’s no way you can make all those beautiful things without having joy in your heart. And sharing it with others, That’s love, baby. My mom used to say, “I’m going to play in the garden” I think we should take that attitude in every thing we do...playing. Even just using that word would make a lot of difference in our attitude.

Ah, I think you misunderstood me. I think I should have said 'lazing around'. I do absolutely love what I do! Otherwise I would have given up long ago! It is fun and I am happy to do it. Many think it's an easy lax profession, but don't be fooled there is much on the go all the time especially if it's a one 'woman' show. I also teach at a college so I do know that attitude is super important! Gotta run and 'do some making'...

Congratulations!

Major accomplishment! We paid ours off last year and it has been wonderful not to have a mortgage. Now if the property taxes could be permanent be paid off, now that would be a beautiful thing.

Wouldn't it though!! That's part of why it's anticlimactic. It's not like you're bill free. It's just one of many, lol. ~ karen!

YES!!! Congratulations and happy day! Yeah, into the bank and on to the wealth manager mine goes. (I love saying that, instead of financial advisor. Sounds ever so much more posh, eh?

Congratulations Karen. A long (possibly hard) haul, and you've done it.

A major accomplishment !

Cheers!

I think I love you. It's 3am and why am I reading your blog instead of finishing my spring-house junk-purge? Because your blog makes my laugh every out loud every time I read it. Your writing is an inspiration - seriously. Congratulations on officially owning your house! Now let us know what you invest in with all that extra dough, why and how it's performing. Unless you take the cash and produce the first ever finger puppet 1-Squirrel West Side Story - which I think Lin Manuel Miranda would approve of ("And the 1st Tony awarded to a finger puppet show goes to...").

I think it's hilarious that what you should be doing at 3 a.m. is cleaning your house and not sleeping, lol! ~ karen!

In Scotland it’s a tradition to paint your front door red when the mortgage is paid off. That would only use a teensy bit of your newly burgeoning bank account.

Such a cool idea! If you don't want to commit, you could wrap it in red wrapping paper for a day and put a big bow on it, then sit in front of it on the porch and drink the bubbly.

I vote for the Sloth Puppet‼️ You have to, have to treat yourself‼️ You have earned it‼️ Once you treat yourself, you can cogitate with your Sloth and become inspired for your next project‼️😊 Maybe a Sloth Castle❓❓❓❓❓❓

Hairdryer. Get the hairdryer. And, if I may be so bold, Dyson’s stick vac too. Also life changing. Use Ebates to get some cash back. That way it won’t seem quite so profligate.

Paid our mtge off a few years ago and didn’t do anything special. But the satisfaction of the words ‘clear title’ always gives me a thrill.

Hearty congratulations for this great accomplishment and for having your head screwed on oh so right.

Before you get used to the extra income and start spending more and have nothing to show for it but more stuff (that you then have to get rid of) why not put that monthly house payment into a real estate investment? You could buy a single family home and then let the renters pay the mortgage. And then put your profits into another one, etc. Eventually you could retire on the passive income generated by the rentals. And blog when you feel like it, not because you have to...although we’d miss you if we didn’t hear from you as often. At the very least you could afford better vacations.

Fabulous news and congratulations...now buy the puppet...go on......for us.... ;-)

Congratulations! That's a real accomplishment! I agree with others, buy something you want and that you will be able to use for some time. I am trying to pay down our mortgage, 2 payments a month as we are retirement age and don't want the mortgage payments with less income. Scrimping now will be worth it. Good luck on whatever you decide! :)

I saw your Canada down coat you love in two other colors on sale today but can't remember where....Have a spa day and eat some really nice chocolate. Many congrats for the hard work!

I remember when my parents paid off their first mortgage. My mother’s “what now?” Came almost immediately. The next morning she was out looking at properties to buy, either normal family homes to rent out or farmland she could rent out. Whatever it was, her money was going to WORK for her!

She passed 2 years ago and all of her kids, her grand kids and her great grand kids benefitted from the way she made the money work.

I took her money and bought property and had a house built. I budgeted to the penny and got exactly what I wanted.

The rest of my money went to the investment lady. I have my monthly budget and I get a check sent. Life is easy.

C O N G R A T U L A T I O N S !!!!!!!

Yay for you! I remember quitting smoking and thinking about the extra $10 a week or so I would have. I wish I had bought squirrels.

Technically, I still have that $10 to spare since I have not started again. Where is that link...?

LOL!

Both Cathy Bates and I are laughing at your comment about squirrels!!!!

Buy a castle or eat organic...yup... or eat Siberian Donkey Cheese...

https://spoonuniversity.com/lifestyle/10-most-expensive-cheeses

But you'd probably figure out a way to make it for the cost of a squirrel puppet